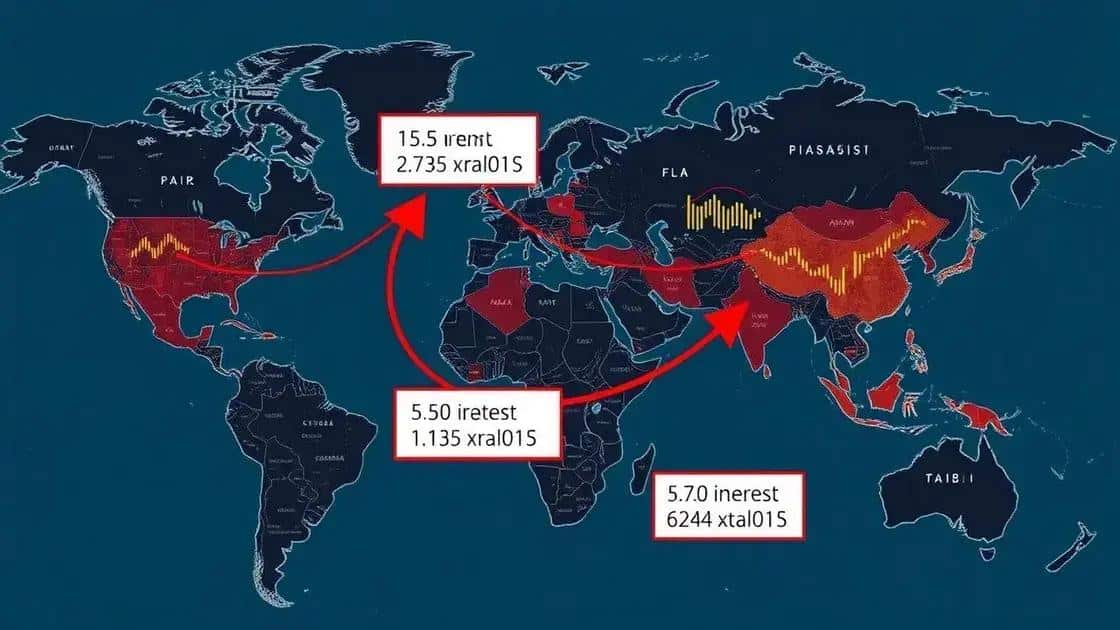

Emerging market responses to Federal Reserve moves impact

Emerging market responses to Federal Reserve moves impact include currency fluctuations, shifts in foreign investments, and adjustments in monetary policies to stabilize economies amidst changing interest rates.

Emerging market responses to Federal Reserve moves impact are crucial to understanding shifts in the global economy. Have you considered how these changes might affect your investments and financial strategies? Let’s delve into this intriguing topic.

Understanding the Federal Reserve’s role

The Federal Reserve plays a crucial role in the U.S. economy. It manages monetary policy, which affects interest rates, inflation, and overall economic stability. Understanding how the Fed operates is essential for anyone interested in economics, especially in how its actions influence emerging markets.

One key function of the Federal Reserve is to set the federal funds rate. This rate influences borrowing costs for banks, which trickles down to consumers and businesses. When the Fed raises or lowers this rate, it can have a profound impact on economic activities, including investments in emerging markets.

The Fed’s Tools for Economic Control

The Fed utilizes several tools to guide the economy. These include:

- Open market operations: Buying and selling government securities to influence liquidity.

- Discount rate: The interest rate charged to commercial banks for loans from the Fed.

- Reserve requirements: Setting the amount of funds banks must hold in reserve.

When the Federal Reserve decides to increase interest rates, emerging markets often respond by tightening their own monetary policies. This is done to avoid capital flight, where investors pull out their money to seek higher returns elsewhere.

Inflation and Interest Rates

Inflation is another crucial area of concern. The Fed aims to maintain a low and stable inflation rate, which helps provide a predictable economic environment. If inflation rises too quickly, the Fed may respond by increasing interest rates, which can lead to:

- Higher costs of borrowing.

- Slower economic growth.

- Potential impacts on exchange rates.

For emerging markets, a sudden change in U.S. interest rates can create volatility. Investors might shift their focus back to the U.S., making emerging markets less attractive in the short term. This delicate balance highlights how interconnected these economies are.

Understanding the Federal Reserve’s role not only illuminates its impact on the U.S. economy but also underscores its significant influence on global markets. As the Fed responds to economic data, emerging markets must adapt swiftly to maintain stability. By staying informed about these trends, investors can make better choices regarding their assets.

How emerging markets react to interest rate changes

When the Federal Reserve changes interest rates, emerging markets often react in significant ways. These reactions can affect everything from foreign investments to exchange rates. Understanding these responses is vital for investors looking to navigate global finance.

One primary way emerging markets respond is through monetary policy adjustments. When U.S. interest rates rise, many emerging economies may choose to increase their own rates as well. This is done to avoid capital flight, which occurs when investors pull their capital out seeking better returns elsewhere.

Key Reactions of Emerging Markets

Emerging markets typically react by:

- Adjusting their interest rates: To remain competitive and attract foreign investments.

- Managing currency stability: A stronger dollar can lead to depreciation of local currencies.

- Influencing capital flows: Higher interest rates in the U.S. might divert funds from emerging markets.

This adjustment process is critical for maintaining economic balance. For instance, countries may intervene in foreign exchange markets to stabilize their currencies against the dollar. If a currency depreciates too much, it can lead to increased inflation, making imported goods more expensive.

The Role of Investor Sentiment

Investor sentiment also plays a crucial role. When the Fed increases rates, it often signals a stronger U.S. economy. This can lead to positive market reactions in emerging economies, where investors may become more cautious. They often reassess their risk exposure, which can impact stock prices and bond yields.

Moreover, emerging markets with strong fundamentals may weather these changes better than those with weaker economic stability. Countries with solid trade balances and low debt levels are likely to attract ongoing interest despite shifts in U.S. monetary policy.

In summary, interest rate changes by the Federal Reserve heavily influence emerging markets. Investors and policymakers must remain vigilant in these dynamics, adapting their strategies to mitigate risks associated with fluctuating global conditions.

The impact on global trade dynamics

The impact on global trade dynamics is significant when the Federal Reserve changes interest rates. These adjustments can alter supply and demand for goods worldwide. As rates rise or fall, businesses and consumers respond accordingly, affecting trade patterns across nations.

When the Fed increases interest rates, borrowing costs for businesses and consumers also rise. This can lead to lower consumption and investment in the U.S., which may decrease demand for imports. Consequently, countries that export goods to the U.S. might face declines in their trade volumes. This situation often forces exporters to reconsider their strategies.

Effect on Exports and Imports

This shift can have several direct effects on global trade:

- Increased costs: Higher U.S. interest rates may lead to reduced purchasing power for American consumers, impacting imports.

- Currency fluctuations: A stronger U.S. dollar often makes U.S. goods more expensive abroad, leading to decreased exports.

- Affected supply chains: Global supply chains may need to adjust to new demand patterns, affecting production and distribution networks.

Emerging markets, in particular, feel the pinch. As the Fed’s policies tighten spending in the U.S., emerging economies that rely on American imports may experience slowdowns. This situation can prompt those countries to seek new markets or adjust their export strategies.

Revising Investment Strategies

The changes in trade dynamics also lead businesses to revise their investment strategies. Companies may look to diversify their supply chains to reduce reliance on U.S. markets. This diversification can involve seeking consumers in other regions, which can create new opportunities but also bring challenges.

Furthermore, the adjustments of trade dynamics influenced by the Fed’s interest rate policies can have a ripple effect, shaping economic policies in other countries. Policymakers must remain vigilant and responsive to these shifts to maintain their economies stable.

In essence, understanding the impact on global trade dynamics due to the Federal Reserve’s interest rate changes is crucial. By recognizing these effects, businesses and investors can better prepare for the potential challenges and opportunities that arise in the ever-evolving global market.

Investment strategies during Fed transitions

Investment strategies during Fed transitions are crucial for adapting to changes in monetary policy. When the Federal Reserve raises or lowers interest rates, investors need to reevaluate their portfolios and consider their risk exposure.

One popular strategy is to focus on diversification. By spreading investments across various asset classes, such as stocks, bonds, and real estate, investors can minimize risk during times of uncertainty. Different asset classes may react differently to interest rate changes, providing a buffer against potential losses.

Key Investment Strategies

Investors can consider several methods to navigate these transitions:

- Interest-sensitive sectors: Identify sectors that usually respond favorably to rate changes, such as financials when rates rise.

- Fixed-income investments: Adjust bond holdings according to interest rate expectations. Longer-term bonds may be more sensitive to rate changes.

- Quality stocks: Invest in companies with strong balance sheets and stable earnings, as they tend to weather economic fluctuations better.

Another approach is to remain flexible. Being open to shifting investment strategies as new data emerges can help investors stay ahead. Monitoring economic indicators, such as employment rates and inflation, is essential for making informed decisions.

Finding Opportunities in Market Changes

During Fed transitions, market volatility can also present investment opportunities. For example, when the Fed signals potential rate hikes, stock prices in certain sectors may drop, creating buying opportunities for long-term investors.

Finally, having a solid exit strategy is crucial. Knowing when to sell investments, especially in volatile markets, can help secure profits or minimize losses. Investors should regularly reassess their financial goals and risk tolerance as Fed policies shift.

By adopting a proactive approach and understanding investment strategies during Fed transitions, investors can navigate these changing landscapes effectively and strive for financial success.

Case studies of recent market shifts

Analyzing case studies of recent market shifts can provide valuable insights into how emerging markets respond to the Federal Reserve’s changes in interest rates. These examples illustrate the interconnectedness of global financial systems and the effects of U.S. monetary policy.

One notable case is the reaction of Brazilian markets following the Fed’s rate hikes in 2022. As the U.S. increased interest rates to combat inflation, the Brazilian real weakened significantly. Investors pulled out capital seeking higher returns in the U.S. This situation forced the Brazilian Central Bank to raise interest rates to stabilize the currency and retain foreign investment.

Key Case Studies

Several key case studies highlight the impact of Fed transitions:

- Turkey’s economic response: After the Fed’s interest rate changes, the Turkish lira experienced volatility. The government increased rates to combat inflation, which resulted in short-term stabilization.

- South African markets: South Africa faced a sell-off in its bonds following the Fed’s signaling of potential rate hikes. The resultant currency depreciation prompted local adjustments in monetary policy.

- Indian equity markets: India saw fluctuations in its stock market as global investors reacted to anticipated rate changes. The Reserve Bank of India monitored inflation closely to adjust its interest rates accordingly.

These instances reveal that the Fed’s actions can lead to immediate ripple effects across various economies. Countries often implement quick adjustments in their monetary policies to counterbalance these impacts. For example, when investors move to the U.S. for safer returns, emerging economies experience capital outflows.

Adapting to Market Conditions

As we analyze these case studies, it becomes clear that adaptability is crucial. Policymakers in emerging markets often need to revise their economic strategies based on how foreign capital reacts to U.S. interest rates. This results in ongoing adjustments to keep their economies robust.

Ultimately, understanding the implications of these market shifts helps investors and policymakers navigate the complex landscape shaped by the Federal Reserve and its influence on global finance.

FAQ – Questions about Emerging Markets and Federal Reserve Impact

How do changes in the Federal Reserve’s interest rates affect emerging markets?

Changes in the Fed’s interest rates can lead to currency fluctuations, capital movements, and economic policy adjustments in emerging markets.

What are some common investment strategies during Fed transitions?

Investors typically focus on diversification, monitor interest-sensitive sectors, and adjust fixed-income investments according to rate expectations.

Can you provide examples of how specific countries have reacted to Fed changes?

Countries like Brazil and Turkey have adjusted their monetary policies in response to U.S. interest rate hikes, affecting their currencies and inflation rates.

Why is it important for investors to stay informed about Fed policies?

Being aware of Fed policies helps investors make smarter decisions, adapt their strategies, and respond proactively to potential market shifts.