US Stock Market Trends: 2025 Forecast & Key Sectors

The US Stock Forecast 2025 indicates a dynamic landscape influenced by technological advancements, evolving consumer behaviors, and geopolitical factors, with specific sectors poised for significant shifts in the coming months.

As we navigate the mid-point of 2024 and look ahead, understanding the potential trajectory of the US Stock Market Trends for the Next 6 Months: Key Sectors to Watch in 2025 becomes paramount for investors. The financial landscape is ever-evolving, shaped by a confluence of economic indicators, technological advancements, and global events. This period is expected to bring both opportunities and challenges, requiring a nuanced approach to investment strategy. By examining the underlying forces at play, we can better anticipate which sectors are likely to lead the charge and which may face headwinds.

Understanding the Current Economic Climate and Its Impact

The current economic climate serves as the bedrock for any stock market forecast. Inflationary pressures, interest rate policies by the Federal Reserve, and global supply chain dynamics all play crucial roles in shaping investor sentiment and corporate earnings. A clear grasp of these macroeconomic factors is essential for making informed decisions about the future direction of the market.

Recent data suggests a mixed economic picture. While some sectors show robust growth, others are experiencing a slowdown, reflecting ongoing adjustments post-pandemic. Labor market strength, consumer spending habits, and geopolitical stability remain significant variables that could influence market performance over the next six months. Investors are keenly watching for signs of economic resilience or potential deceleration.

Inflation and Interest Rates: A Persistent Influence

Inflation continues to be a key concern, directly impacting corporate profitability and consumer purchasing power. The Federal Reserve’s response, primarily through interest rate adjustments, has a ripple effect across all asset classes.

- Monetary Policy: The Fed’s stance on interest rates will heavily influence borrowing costs for businesses and individuals, affecting investment and consumption.

- Consumer Price Index (CPI): Monitoring CPI data provides insights into inflationary trends, which can dictate the Fed’s future actions.

- Corporate Earnings: Higher inflation can erode corporate profit margins if companies cannot pass on increased costs to consumers.

The interplay between inflation and interest rates will likely define the broader market narrative for the remainder of the year and into early 2025. A stable inflation environment coupled with a measured approach from the Fed could provide a more predictable backdrop for equity markets, while any surprises could introduce volatility.

Technology Sector: Innovation Driving Growth in 2025

The technology sector consistently remains a powerhouse in the US stock market, and its influence is only expected to grow in 2025. Innovation continues at a rapid pace, with artificial intelligence (AI), cloud computing, and cybersecurity leading the charge. These sub-sectors are not just enhancing existing industries but are also creating entirely new markets, offering significant growth potential for investors.

Companies at the forefront of these technological advancements are likely to see sustained demand for their products and services. The increasing integration of AI into everyday applications, the critical need for robust cybersecurity solutions, and the ongoing shift to cloud-based infrastructure all point towards continued expansion within this dynamic sector. However, regulatory scrutiny and competition will also be factors to monitor.

Artificial Intelligence (AI): The Next Frontier

AI is perhaps the most transformative technology of our time, with applications spanning from healthcare to finance. Its potential to enhance productivity and create new revenue streams is immense.

- Generative AI: Advances in generative AI are creating new content, design, and coding capabilities, impacting numerous industries.

- AI Infrastructure: Demand for specialized hardware (GPUs) and software platforms to support AI development and deployment is booming.

- Ethical AI: Growing focus on responsible AI development and deployment could lead to new regulatory frameworks and specialized services.

The continued investment in AI research and development, coupled with its expanding practical applications, positions this sub-sector for robust performance. Investors should look for companies with strong intellectual property and a clear strategy for integrating AI into their core business models.

Healthcare and Biotechnology: Resilience and Breakthroughs

The healthcare and biotechnology sectors are traditionally defensive, offering stability during economic downturns, but also presenting significant growth opportunities driven by innovation. Demographic shifts, such as an aging population, and advancements in medical science continue to fuel demand for healthcare services, pharmaceuticals, and cutting-edge biotechnologies. This combination of resilience and growth potential makes these sectors compelling for investors in 2025.

Breakthroughs in areas like gene therapy, personalized medicine, and chronic disease management are not only improving patient outcomes but also opening up vast new markets. The ongoing need for accessible and effective healthcare solutions ensures a steady revenue stream for established players, while smaller, agile biotech firms often promise high returns through successful drug development or medical device innovations.

Personalized Medicine and Gene Therapies

The ability to tailor medical treatments to individual genetic profiles is revolutionizing healthcare, leading to more effective and less invasive interventions.

- Targeted Treatments: Development of drugs and therapies designed for specific patient populations based on genetic markers.

- CRISPR Technology: Advancements in gene editing offer potential cures for previously untreatable genetic diseases.

- Diagnostic Tools: Innovations in diagnostics are enabling earlier and more accurate disease detection, driving demand for new technologies.

The regulatory environment, particularly the FDA approval process, will remain a critical factor for companies in this space. However, the long-term trends of scientific advancement and demographic needs strongly support continued growth in healthcare and biotechnology.

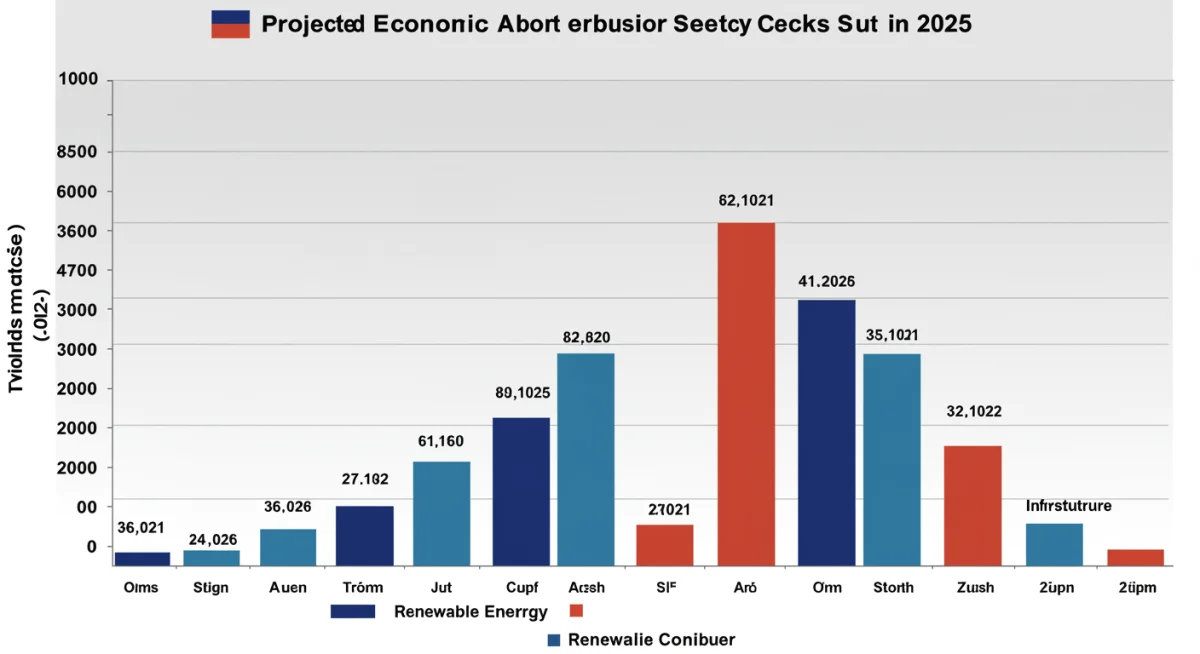

Renewable Energy and Infrastructure: The Green Transition

The global push towards sustainability and decarbonization positions the renewable energy and infrastructure sectors for significant expansion in the coming years, with 2025 being a crucial period. Government incentives, increasing consumer demand for eco-friendly solutions, and technological improvements are driving massive investments in solar, wind, and other clean energy sources, as well as the infrastructure required to support them.

Beyond energy generation, the focus extends to grid modernization, electric vehicle charging networks, and sustainable urban development. These areas represent not only environmental imperative but also substantial economic opportunities. Companies involved in energy storage, smart grid technologies, and sustainable materials are particularly well-positioned to capitalize on these trends.

Solar and Wind Power: Scaling Up Capacity

Solar and wind continue to be the dominant forces in renewable energy, with ongoing efforts to increase efficiency and reduce costs.

- Utility-Scale Projects: Large-scale solar farms and wind turbine installations are expanding rapidly across the US.

- Distributed Generation: Growth in rooftop solar and community energy projects is empowering consumers and increasing grid resilience.

- Offshore Wind: Significant investments are being made in offshore wind development, particularly along the East Coast, promising substantial new energy capacity.

The policy landscape, including tax credits and subsidies, will continue to play a vital role in accelerating the green transition. As the push for energy independence and climate action intensifies, these sectors are expected to attract considerable investment.

Financial Services: Adapting to Change and Innovation

The financial services sector, while traditionally viewed as stable, is undergoing significant transformation driven by technological innovation and evolving regulatory frameworks. In 2025, the sector will likely navigate a complex environment of fluctuating interest rates, digital disruption, and increasing demand for personalized financial products. Companies that can adapt quickly to these changes and embrace new technologies like blockchain and AI are most likely to thrive.

Fintech innovations are reshaping everything from payment processing to wealth management, offering more efficient and accessible services. Traditional banks and financial institutions are investing heavily in digital transformation to remain competitive, while new players are emerging with disruptive business models. The regulatory landscape, especially concerning digital assets and consumer protection, will also be a key factor influencing sector performance.

Digital Transformation and Fintech Integration

The integration of technology into financial services is creating new efficiencies and opportunities, fundamentally changing how consumers and businesses interact with their money.

- Mobile Banking: Continued growth in mobile-first financial solutions, offering convenience and accessibility.

- Blockchain and Digital Assets: Exploration and adoption of blockchain technology for secure transactions and the emergence of regulated digital assets.

- Personalized Financial Advice: AI-powered tools are enabling more tailored investment advice and financial planning for individuals.

The ability of financial institutions to leverage data analytics and AI to understand customer needs better and offer bespoke solutions will be crucial for success. Cybersecurity will also remain a paramount concern, given the sensitive nature of financial data.

Consumer Discretionary: Shifting Preferences and Economic Resilience

The consumer discretionary sector, encompassing goods and services not deemed essential, is often a strong indicator of consumer confidence and economic health. In the next six months of 2025, its performance will largely hinge on disposable income levels, employment rates, and evolving consumer preferences. While inflation could temper spending on non-essentials, a resilient labor market and targeted spending in certain categories could still provide pockets of growth.

E-commerce continues to reshape retail, with brands that offer seamless online experiences and strong brand loyalty poised for success. Experiences over material goods, sustainable products, and personalized services are growing trends that companies in this sector must address. The ability to innovate and adapt to these shifting consumer values will differentiate winners from losers.

E-commerce and Experiential Spending

The continued dominance of online retail and a growing preference for experiences over possessions are key trends shaping consumer spending.

- Online Retail Growth: Further penetration of e-commerce across various product categories, driven by convenience and selection.

- Travel and Leisure: Continued recovery and growth in travel, hospitality, and entertainment as consumers prioritize experiences.

- Sustainable Consumption: Increasing demand for ethically sourced and environmentally friendly products, influencing purchasing decisions.

Companies that can effectively leverage data to understand consumer behavior and offer innovative, value-driven products and experiences will be well-positioned. However, economic downturns or sustained high inflation could quickly impact this sector, making it more sensitive to macroeconomic shifts.

| Key Sector | 2025 Outlook |

|---|---|

| Technology | Strong growth driven by AI, cloud computing, and cybersecurity innovations. |

| Healthcare & Biotech | Resilience and growth from personalized medicine, gene therapies, and aging demographics. |

| Renewable Energy | Significant expansion due to green transition, government incentives, and infrastructure investment. |

| Financial Services | Adapting to digital disruption and fintech integration amidst evolving regulatory landscapes. |

Frequently Asked Questions About 2025 US Stock Market Trends

Key influences include the Federal Reserve’s interest rate policy, inflation trends, geopolitical stability, and technological advancements, particularly in AI. Consumer spending and corporate earnings reports will also provide crucial insights into market direction and investor confidence.

Technology, especially AI and cloud computing, is projected for strong growth. Healthcare and biotechnology will benefit from innovation and demographic shifts. Renewable energy and infrastructure are also poised for significant expansion due to global decarbonization efforts and government incentives.

Persistent inflation could lead to higher interest rates, increasing borrowing costs and potentially tempering corporate profits. Investors might favor companies with strong pricing power or those in defensive sectors. It’s crucial to monitor inflation data and adjust portfolios accordingly to mitigate risk.

Potential risks include unforeseen geopolitical events, persistent high inflation leading to aggressive Fed policies, supply chain disruptions, and regulatory changes impacting major sectors. Economic slowdowns or recessions also remain a possibility, necessitating careful risk management.

Technological innovation, particularly in artificial intelligence, will be a primary growth driver. It will reshape industries, enhance productivity, and create new market opportunities across various sectors, including healthcare, finance, and consumer services. Companies embracing these advancements will likely outperform.

Conclusion

Forecasting US Stock Market Trends for the Next 6 Months: Key Sectors to Watch in 2025 reveals a landscape brimming with both opportunities and complexities. While the technology, healthcare, and renewable energy sectors appear poised for significant growth driven by innovation and societal shifts, investors must remain vigilant to macroeconomic factors like inflation, interest rates, and geopolitical developments. A diversified approach, coupled with a keen understanding of evolving industry dynamics, will be crucial for navigating the market effectively. Staying informed and adaptable will empower investors to make strategic decisions that align with their financial goals in this dynamic environment.